Contents

These services permit straight-through processing, improving speed of transactions and reduced errors. For more information about the FXCM’s internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms’ Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here.

Is forex real money?

Forex trading can be legitimate for governments and large institutional investors concerned about fluctuations in international exchange rates, and it can even be appropriate for some individual investors. But the average investor should be wary when it comes to forex offers.

FXTM’s comprehensive range of educational resources are a perfect way to get started and improve your trading knowledge. You’ll find everything you need to know about forex trading, what it is, how it works and how to start trading. If the EUR/USD exchange rate is 1.2, that means €1 will buy $1.20 (or, put another way, it will cost $1.20 to buy €1).

If a Greek coin held more gold than an Egyptian coin due to its size or content, then a merchant could barter fewer Greek gold coins for more Egyptian ones, or for more material goods. This is why, at some point in their history, most world currencies in circulation today had a value fixed to a specific quantity of a recognized standard like silver and gold. In the next section, we’ll reveal WHAT exactly is traded in the forex market. The FX market is a global, decentralized market where the world’s currencies change hands. Exchange rates change by the second so the market is constantly in flux.

What is the spread in forex trading?

For example, destabilization of coalition governments in Pakistan and Thailand can negatively affect the value of their currencies. Similarly, in a country experiencing financial difficulties, the rise of a political faction that is perceived to be fiscally responsible can have the opposite effect. Also, events in one country in a region may spur positive/negative interest in a neighboring country and, in the process, affect its currency. During the 1920s, the Kleinwort family were known as the leaders of the foreign exchange market, while Japheth, Montagu & Co. and Seligman still warrant recognition as significant FX traders. By 1928, Forex trade was integral to the financial functioning of the city.

Trading forex involves the buying of one currency and simultaneous selling of another. In forex, traders attempt to profit by buying and selling currencies by actively speculating on the direction currencies are likely to take in the future. As a leading global broker, we’re committed to providing flexible services tailored to the needs of our clients. As such, we are proud to offer the most popular trading platforms in the world – MetaTrader 4 and MetaTrader 5 . Our traders can also use the WebTrader version, which means no download is required, while the MT apps for iOS and Android allow you to trade the markets on the go, anytime and anywhere. There are two main types of analysis that traders use to predict market movements and enter live positions in forex markets – fundamental analysis and technical analysis.

One unique aspect of this international market is that there is no central marketplace for foreign exchange. Rather, currency trading is conducted electronicallyover the counter , which means that all transactions occur via computer networks among traders around the world, rather than on one centralized exchange. This means that when the U.S. trading day ends, the forex market begins anew in Tokyo and Hong Kong.

Day traders require technical analysis skills and knowledge of important technical indicators to maximize their profit gains. Just like scalp trades, day trades rely on incremental gains throughout the day for trading. Remember that the trading limit for each lot includes margin money used for leverage. This means that the broker can provide you with capital in a predetermined ratio. For example, they may put up $100 for every $1 that you put up for trading, meaning that you will only need to use $10 from your own funds to trade currencies worth $1,000. Companies doing business in foreign countries are at risk due to fluctuations in currency values when they buy or sell goods and services outside of their domestic market.

How do I start forex trading?

A currency trading strategy often includes a number of forex signals and technical indicators. A forex trading signal can provide prompts to help determine entry and exit points for a given forex market. These signals can be determined by either manual or automated methods.

However, in FX trading, leverage is the quintessential double-edged sword; it simultaneously boosts profit potential and assumed liability. During volatile periods, an unfortunate turn in price can generate losses in excess of deposited funds. The result can be a premature position liquidation, margin call or account closure. At FXCM, we offer a collection of robust software suites, each with unique features and functionalities. Our flagship platform Trading Station furnishes traders with the utmost in trade execution, technical analysis and accessibility.

Can forex start without money?

Non-deposit bonuses are the most popular way to trade Forex without investment. As the name suggests, to start trading, you do not need an initial deposit; that is, there is no need to deposit personal funds into your account.

Brown & Sons traded foreign currencies around 1850 and was a leading currency trader in the USA. Do Espírito Santo de Silva (Banco Espírito Santo) applied for and was given permission to engage in a foreign exchange trading business. Any news and economic reports which back this up will in umarkets review turn see traders want to buy that country’s currency. Similarly, traders can opt for a standardized contract to buy or sell a predetermined amount of a currency at a specific exchange rate at a date in the future. This is done on an exchange rather than privately, like the forwards market.

Why Forex Trading Matters for Average Consumers

To complete each forex trade, the market’s technological infrastructure matches contradictory orders from market makers, individual traders and other liquidity providers. Forex trading is the same as currency trading, involving the exchange of one currency for another in order to profit from the fluctuating price movements of currency pairs. Foreign exchange, more commonly known as Forex or FX, relates to buying and selling currencies with the goal of making a profit off the changes in their value.

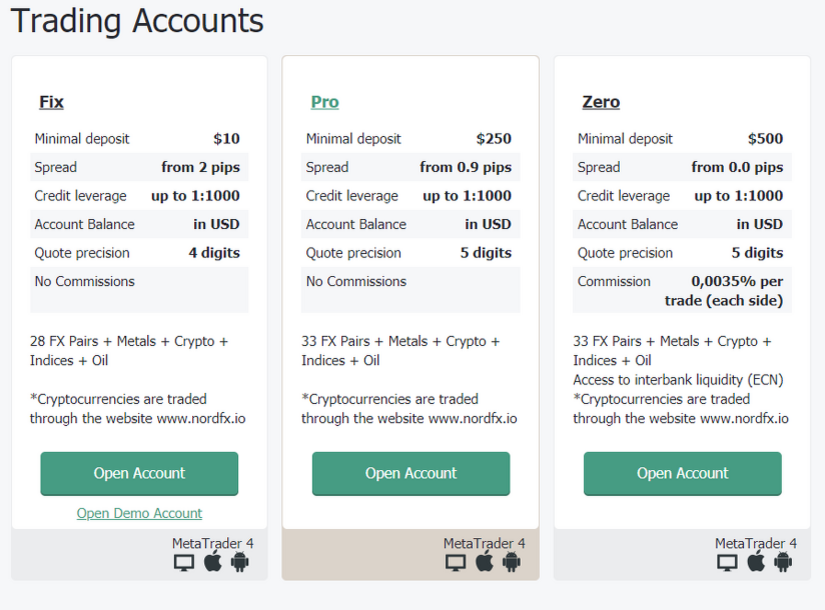

It involves anticipating where a currency’s price is likely to move, entering a position, and seizing a portion of the potential profit if that move happens. Kindly note that this involves buying a currency with a high-interest rate while simultaneously selling a currency with a low-interest rate. The type of forex account you choose completely depends on your interests, objectives and the amount of time and money you can invest into forex trading at that particular point in time. Such accounts offer interest-free forex trading with no rollover or any premiums. The benefit of opening a mini or a micro forex account is a low-risk level compared to other means of forex trading. Compared to a standard account where traders can enter into contract sizes of 100,000 units of a standard lot, a mini account only allows 10,000 base currency units.

Retail traders can face substantial risks because of easy access to leverage and lack of understanding of how it all works. For example, a person could exchange the US dollar for the Japanese Yen. Forex offers deep liquidity and 24/7 trading, so investors have ample opportunities to get involved. These bodies set the standards by which every forex broker must comply, which helps ensure that currency trading is ethical and fair.

Are Forex Markets Regulated?

Continental exchange controls, plus other factors in Europe and Latin America, hampered any attempt at wholesale prosperity from trade for those of 1930s London. The foreign exchange market, which is usually known as “forex” or “FX,” is the largest financial market in the world. Please note that foreign exchange and other leveraged trading involves significant risk of loss. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. Like with any type of trading, financial market trading involves buying and selling an asset in order to make a profit.

The highly liquid forex market, combined with access to high leverage, means forex day traders may capitalise on the slight price movements in currencies throughout the day. The idea is to potentially make small profits on multiple trades and attempt to cap losses on unprofitable trades. Typically refers to large commercial banks in financial centers, such as New York or London, that trade foreign-currency-denominated deposits with each other. Major issues discussed are trading volume, geographic trading patterns, spot exchange rates, currency arbitrage, and short- and long-term foreign exchange rate movements.

Who Trades Forex?

In some countries, like Nigeria, the conduct of FX transactions in this market is guided by the wholesale Dutch auction system. Under this system, the authorized arum capital review dealers bid for FX under the auspices of the Central Bank every week. The Central Bank sells FX to only the banks with the winning bids at their bid rates.

Aguaranteed stop losshowever, for which a small premium is charged upon trigger, guarantees to close your trade at the stop loss level you have determined, regardless of any market gapping. BUYa currency pair if you believe that the base currency will strengthen against the quote currency, or the quote currency will weaken against the base currency. If EUR/USD had dropped in price, though, you might have to sell your euros for less than you bought them. To start trading forex, you’ll need to get to know a few key concepts and terms. If you purchase an asset in a currency that has a high interest rate, you may get higher returns.

A wide range of currencies are constantly being exchanged as individuals, companies and organisations conduct global business and attempt to take advantage of rate fluctuations. FX trading, also known as foreign exchange trading or forex trading is the exchange of different currencies on a decentralised global market. It’s one of the largest and most liquid financial markets in the world. Forex trading involves the simultaneous buying and selling of the world’s currencies on this market. There are millions of forex traders all around the world, and all of them believe that trading the forex markets is a good idea. They have come to the online forex markets to explore the potential for opportunity and profits.

Traders can also use trading strategies based on technical analysis, such as breakout and moving average, to fine-tune their approach to trading. Foreign exchange trading volumes from many of these global companies are dramatically larger than even the largest financial institutions, hedge funds, and some governments. Other financial markets simply do not receive the same amount of interest from Main Street corporations because they do not meet their business needs of buying and selling goods in foreign countries. Remote accessibility, limited capital requirements and low operational costs are a few benefits that attract traders of all types to the foreign exchange markets. In addition, forex is the world’s largest marketplace, meaning that consistent depth and liquidity are all but assured. Factor in a diverse array of products, and retail traders enjoy a high degree of strategic freedom.

How much do I need to start trading forex?

The Best Minimum Deposit to Start Forex Trading In General

Starting with a minimum deposit of $100 will allow most traders to open positions on leverage without incurring too much risk as they steadily grow their portfolio.

The forex market is open 24 hours, five days a week – Monday to Friday. Trading begins with the opening of the market in Australia, followed by Asia, and then Europe, followed by the US market until the markets close on the weekend. A bachelor’s degree is required for most entry-level forex trader positions. A degree in economics, business administration, mathematics, statistics, finance, or a finance-related major will be beneficial, but forex traders can come from a variety of different backgrounds. An internship in a trading environment is useful, and any international experience or fluency in multiple languages can be a valuable differentiator from other applicants.

Foreign Exchange Market and Interest Rates

Risk management is crucial for successful forex trading – and a key element of risk management is the use oforders. The first step to opening a forex trade is to decide which currency pair you wish to trade. At City Index, you can speculate on the future direction of currencies, taking either a long or short position depending on whether you think a forex how to make money on forex pair’s value will go up or down. This is called an over-the-counter market, and it means that currency prices are constantly fluctuating in value against each other, potentially offering a greater number of trading opportunities. The first currency listed in a forex pair is called the base currency, and the second currency is called the quote currency.

Summarizing the basics of forex trading

Two appendices further elaborate on exchange rate indexes and the top foreign exchange dealers. As they develop strategies and gain experience, they often build out from there with additional currency pairs and time frames. Individual currencies are referred to by a three-letter code set by the International Organization for Standardization . This uniform code makes everything from evaluating an individual currency to reviewing a foreign currency exchange rate easier.