Content

The comparison between the two ratios indicates that despite the rise in both revenue and cost of sales, the gross profit has changed only marginally. It is important for every company to grow their business over time in order to create shareholder value. Thus, horizontal analysis helps to understand how successfully this has been achieved considering a period of time. Enter the statement line item and the total base figure into the calculator to calculate the vertical analysis. The purpose of an income statement is to show a company’s financial performance over a period. Meanwhile, Sam could also use common size analysis to compare his own financial results to that of previous years.

CAD and CAE tools are widely available in many industrial fields. @CFturboInc offers an example of the design, testing, #analysis, and redesign process for the successful development of a commercial vertical #TurbinePump using these tools. https://t.co/pi4TJduMJJ #PumpTalk pic.twitter.com/9EdslpS3wL

— Empowering Pumps & Equipment (@EmpoweringPumps) May 27, 2021

Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities. To create common-size measures, which enable them to compare and contrast amounts of different magnitudes in a very efficient manner. When looking at Undistributed Operating Expenses, Administrative & General and Sales & Marketing show the largest difference. Maybe you are paying higher credit card commissions, and that is at the root of the higher Administrative & General percentage. Perhaps you have a costly loyalty program in place, or you have launched a new media campaign that is diverting more resources into your Sales & Marketing department. Sales and Marketing, and Administrative and General account for most of Undistributed Operating Expenses. In the end, the Illustration Hotel has only 21.9% of its revenue left as GOP.

Horizontal Analysis Vs Vertical Analysis: How To Use Them To Drive Business Success

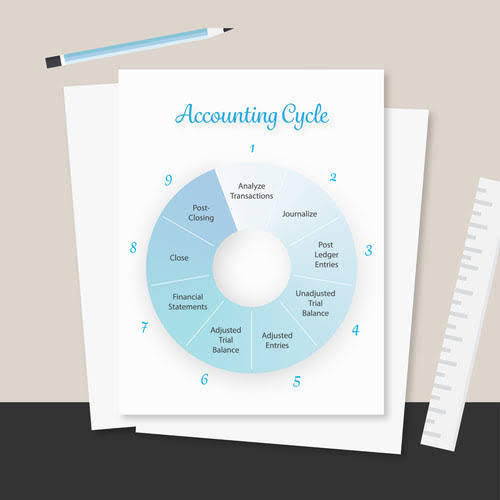

Vertical analysis (often referred to as “common-size” analysis) looks at the composition of the operation at a single point in time, comparing each measure against a base. You can think of this analysis as a snapshot of the operation that shows every measure as a percentage of the base. Because of this, the analysis is independent of property and market specific characteristics, such as business volume and property size. So, while horizontal analysis is a dynamic way of looking at data, vertical analysis deals with the static details. Also known as profit and loss (P&L) statements, income statements summarize all income and expenses over a given period, including the cumulative impact of revenue, gain, expense, and loss transactions.

Does cash flow have vertical analysis?

Vertical analysis is an accounting tool that enables proportional analysis of documents, such as financial statements. … Performing a vertical analysis of a company’s cash flow statement represents every cash outflow or inflow relative to its total cash inflows.

In Horizontal Financial Analysis, the comparison is made between an item of financial statement, with that of the base year’s corresponding item. On the other hand, in vertical financial analysis, an item of the financial statement is compared with the common item of the same accounting period. To conduct a vertical analysis of a balance sheet, express each individual asset account line item as a percentage of total assets. For example, if inventory is $10,000 and total assets is $200,000, write “5%” next to the inventory line item amount.

Understanding The Cash Flow Statement

Thereby, achieving a goal of the budgeting process to determine the firm’s game plan. This ratio is a measure of the ability of a firm to turn Inventory into Sales. In this case, the higher the ratio, the better the business is using Inventory. Because they are turning over their Inventory without the cost of it becoming obsolete. Variance, which is useful in establishing positive or negative changes between periods based on comparison to the average of the squared difference from the mean for the total time measured. Vertical analysis can also be used for comparing the financial statement of a company with its previous year’s financial statements.

However, you can customize your analysis using any measures that you find relevant to the specific question you want to answer. Consider enrolling in Financial Accounting or our other online finance and accounting courses, which can teach you the key financial topics you need to understand business performance and potential. Compare your results to competitors or similar companies in your industry.

Vertical Analysis

Most importantly, Financial Analysis points to the financial destination of the business in both the near future and to its long-term trends. By calculating the difference and converting to percentages, we can quickly create a thumbnail snapshot of revenue growth or contraction. The accounting conventions and concepts are not vigilantly followed in vertical analysis. Earnings management and the financial statementanalyst, Hall, S. C., Agrawal, V., & Agrawal, P. .Accounting and Finance Research,2, 105. Yes it is always 100%,definitely the sales will be used in the income statement.

- Many industries use vertical analysis to measure whether there is an improvement or setback in the performance.

- Likewise, a high percentage rate indicates the need to improve the use of Assets.

- Investigating these changes could help an analyst know if the company is shifting to a different business model.

- For example, management may consider shutting down a particular unit if profit per unit falls below a particular threshold percentage.

- Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money.

- The variance for each item in the Balance Sheet is displayed in a dollar amount as well as the percent difference.

We can see that non-current assets account for 60% of total assets, higher than current. The treasury has an important weight (40%), therefore, it does not seem that there are liquidity problems. Regarding liabilities, we can highlight that the result for the year is more than 30% of the net worth or that long-term debts are the ones that carry the greatest weight. An important consideration when applying this formula is that both measures must be from the same period. For example, you could find labor expenses for the current financial year as a percentage of total revenue for the current financial year. However, it would make no sense to find labor expenses for the current financial year as a percentage of total revenue for December this year.

The Income Statement Vs The Balance Sheet

Vertical analysis is most commonly used within a financial statement for a single reporting period, e.g., quarterly. It is done so that accountants can ascertain the relative proportions of the balances of each account. We can know if the company has more fixed assets (non-current) or on the contrary it has a greater working capital . Bottomline, the Illustration Hotel is not as profitable as its competitive set, but there are many different reasons that could explain this. As with horizontal analysis, vertical analysis is a guide towards relevant strategic questions about your operation, and you should dig further into the data to find the story that makes the most sense. Generally, the chosen bases are Total or Departmental Revenue, because managers want to understand their properties’ revenue mix and expenses flow through. As a standard, when looking at an operating statement, a department’s revenue is the base for its own expenses, and Total Revenue is the base for each department’s revenue, undistributed operating expenses and GOP.

CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Construction Management This guide will help you find some of the best construction software platforms out there, and provide everything you need to know about which solutions are best suited for your business. For this, the percentage of each item of expenses over income is calculated. This technique allows us to verify the economic and financial situation and the income statement and make comparisons with other companies in the same economic sector. On the one hand, it informs us about the weight of each part and, on the other, it allows us to check if we are in the sector average or not.

Methods Of Analyzing A Financial Statement

It displays all items as percentages of a common base figure rather than as absolute numerical figures. For best results, perform vertical analysis on a handful of company balance sheets and calculate the average to establish a baseline balance for each account. Compare your company results to the baseline and note any significant differences.

For example, short-term debt is $50,000 and total liabilities are $200,000. Comparing these numbers to historical figures can help you spot sudden shifts. So, it can be concluded that the vertical analysis of the income statement helps in various financial assessments that primarily include trend analysis and peer comparison. This technique is one of vertical analysis example the easiest methods for analyzing financial statements. However, given its lack of standard benchmark, this method finds limited use in the decision making of most of the companies. The most common use of vertical analysis is within a financial statement for a single reporting period, so that one can see the relative proportions of account balances.

Ways To Analyze An Income Statement

The percentages on a common-size balance sheet allow you to compare a small company’s balance sheets to that of a very large company’s balance sheet. A common-size balance sheet can also be compared to the average percentages for the industry. The balance sheet uses this presentation on individual items like cash or a group of items like current assets. Cash is listed as an individual entry in the assets section with the total balance being listed on the left and its percentage of total assets being listed on the right.

You can see how much debt your company holds in proportion to its assets and how short-term debt directly compares to short-term assets. The higher the proportion of short-term assets, the stronger your company’s working capital position and its ability to meet its near-term obligations. Your company’s balance sheet must adhere to its governing accounting equation of assets equal liabilities plus owner’s equity.

How Are Items In Common

In that, we can easily understand that the total expenses gradually increased from 43% to 52%, and the net income got reduced from 1st year to 2nd year. In the 3rd year, the COGS got decreased when compared to the previous years, and the income got increased. A common size income statement is an income statement in which each line item is expressed as a percentage of the value of sales, to make analysis easier. This shows that the amount of cash at the end of 2018 is 141% of the amount it was at the end of 2014. By doing the same analysis for each item on the balance sheet and income statement, one can see how each item has changed in relationship to the other items. Another powerful application of a vertical analysis is to compare two or more companies of different sizes.

For example, there has been some analysis of NPS unit vulnerability, but how are the adapting in light of vertical and horizontal governance opportunities and constraints? https://t.co/1EKYokh2OP

— Mark Lubell (@EnvPolicyCenter) May 15, 2019

The total revenue is taken as a base item, and other heads of the income statement are presented as a percentage of the base figure. Vertical analysis is used to analyze the different accounts of the financial statements and describe the changes in the relative size of each item. It is a management tool used by companies in analyzing the changes in the relative size of different accounts over several years. It is also helpful in comparing the financial statements of two companies with the industry average. It’s frequently used in absolute comparisons, but can be used as percentages, too.

Net zero-emission pathways reduce the physical and economic risks of climate change – Nature.com

Net zero-emission pathways reduce the physical and economic risks of climate change.

Posted: Mon, 29 Nov 2021 16:28:08 GMT [source]

If the trend percentage is greater than 100%, it means the balance in that year has increased over the base period. E.g. HGY Company’s income statement for the year ended 2016 is shown below along with the financial results for the year 2015. Trends in gross margin generally reveal how much pricing power a company has. Here’s an example of an income statement from a fictional company for the year that ended on September 28, 2019.

What is the difference between horizontal and vertical?

A vertical line is any line parallel to the vertical direction. A horizontal line is any line normal to a vertical line. … Vertical lines do not cross each other.

On the balance sheet, the base amount is total assets or total liabilities and owners’ (or shareholders’) equity. You can use horizontal analysis to examine your company’s profit margins over time, and create strategic spend projections to match projected revenue growth or hedge against seasonality or increased cost of materials. Such a technique also helps in identifying where the company has put the resources.

Metagenomic discovery of CRISPR-associated transposons – pnas.org

Metagenomic discovery of CRISPR-associated transposons.

Posted: Mon, 29 Nov 2021 21:07:25 GMT [source]

For the balance sheet, the total assets of the company will show as 100%, with all the other accounts on both the assets and liabilities sides showing as a percentage of the total assets number. For example, when a vertical analysis is done on an income statement, it will show the top-line sales number as 100%, and every other account will show as a percentage of the total sales number. In accounting, a vertical analysis is used to show the relative sizes of the different accounts on a financial statement. Firms of different sizes can be compared easily as all the items are expressed as a percentage. Comparison of financial performance and position of firms of different sizes is not very useful when absolute figures are considered. Horizontal analysis is a common technique used to examine the changes in the line items of the income statement and the balance sheet from year to year.

The ability to spot this trend over time empowers you to intervene and be pro-active in solving the problem. For instance, a large increase in Sales returns and allowances coupled with a decrease in Sales over two years would be cause for concern. If this is the case, you need to address and solve the problem or the company’s reputation and future may be at stake. Analysis of Financial Statements determines the strength of a business and where there is room for improvement. The search for answers to these questions begins with an analysis of the firm’s Financial Statements.

Author: David Ringstrom