Content

115–141, set out as a note under section 23 of this title. 91–172, set out as a note under section 511 of this title. 91–172, set out as an Effective Date note under section 4940 of this title. 93–625, set out as an Effective Date note under section 527 of this title.

"The definition of charity does not equal 501c3." – Brad Newman #ciw #philanthropy

— Elisha-Rio P. Apilado, MA, ATR-P (@erioapilado) October 9, 2012

While foundations are often primarily engaged in grantmaking activities, some may engage in their own direct charitable activities or programs. When thinking about foundations in the charitable context, it is helpful to see how the IRS describes private foundations and public charities. Visit the Charities and Nonprofits section of the IRS website at A private foundation is typically funded by an individual or family.

Domestic Nonprofit Corporation

Most of the following terms are not legal classifications, but rather descriptive terms used within the field of philanthropy to help others understand how the foundation operates. What these foundations have in common is that they are established to aid social, educational, religious, or other charitable needs. Generally, there is a board of directors that makes discretionary giving decisions, often within specific guidelines as to charitable field of interest and/or geographic area. Charities are a large and diverse group of nonprofit institutions that play a key role in American society and help to form and strengthen communities. With the help of millions of volunteers and the generosity of countless donors, they provide many services and perform many functions that in some countries are largely performed by government.

Question from vendor/qualified organizations on the use of the Annual Exemption Letter, contact Tax Policy. Provide a written statement attesting that the items purchased or leased will be used exclusively for training, job placement or rehabilitation programs or testing for mentally or physically disabled persons. Provide a current list of locations that are used exclusively for training, job placement or rehabilitation programs or testing for mentally or physically disabled persons. Copy of the organization’s most recently filed IRS Form 990 or 990-EZ, including all schedules. Includes clinics that are being constructed as qualifying community health centers. This application procedure applies to any qualifying Facility Under Construction and that upon completion will be an organization that qualifies as a qualifying hospital.

In this section, you state the name, addresses, and phone numbers of your incorporator. Please do not use incorporation services to incorporate. Your registered agent has one job and one job only and it’s corresponding with the incorporating state. She or he will handle all legal correspondence, letters, notifications 501c3 definition and such. It is important to know that your registered agent should be a resident of the incorporating state which is not difficult to do since you absolutely should not incorporate in a non-resident state anyway. Your corporation and registered agent’s address must be in the incorporating State with no exception.

The 501c3 Exempt Organization

In this case, you state that this organization shall have no members and don’t ever look back. For the sake of the incorporation, the incorporator SELECTS the initial directors. I say select, because you are not a nonprofit corporation yet, and it’s meaningless to have a board meeting when you don’t have a board to speak of. The court upon a finding that this section is applicable shall select the qualifying organization or organizations to receive the assets to be distributed, giving preference if practicable to organizations located within the State of Montana.

Defining an Equity Strategy: Guidelines for Public Agencies – transitcenter.org

Defining an Equity Strategy: Guidelines for Public Agencies.

Posted: Wed, 22 Sep 2021 07:00:00 GMT [source]

Under the Lobbying Disclosure Act, this generally includes members of Congress, their staffs, committee staffs, and executive branch officials. Contact with a covered official in order to affect policy generally constitutes lobbying activity, with certain exceptions. Access accreditation data on early learning and higher education program characteristics and quality for research purposes.

The platform offers granular permissions that give you total control over who can view various parts of the portal. The IRS also looks at where each organization’s primary financial support comes from. That puts private foundations in a little different classification than charitable organizations and churches/religious organizations. In contrast to the prohibition on political campaign interventions by all section 501 organizations, public charities may conduct a limited amount of lobbying to influence legislation.

Search Foundation Directory Online

Fiscal sponsorship is often used by newly formed nonprofits that need to raise money during the start-up phase, before they are recognized as tax-exempt by the IRS. Using a fiscal sponsor enables a program or organization that does notitselfqualify as tax-exempt to attract funding for its operations that will — through the fiscal sponsor – be tax-deductible to donors. Therefore fiscal sponsor arrangements benefit organizations or programs that are not tax-exempt by providing a flow-through pathway for revenue that the organization may not otherwise be in a position to receive. Giving to a public charity is attractive to many donors because the gift is tax deductible to the donor. While other circumstances may alter these deductions on an individual basis, generally a single donor deduct from taxable income a gift of up to 50 percent of his or her income. A corporation is limited to deducting for tax purposes a gift of 10 percent or less of its revenue.

The DMLP was a project of the Berkman Klein Center for Internet & Society from 2007 to 2014. Due to popular demand the Berkman Klein Center is keeping the website online, but please note that the website and its contents are no longer being updated. Please check any information you find here for accuracy and completeness.

Foundation Basics

501 private foundations are generally not permitted to engage in lobbying but may fund grantees with general support that the grantees decide to use for lobbying. 501 organizations often discount their ability to engage in substantial permissible advocacy-related activities, includingissue advocacy, get-out-the-vote drives, and voter registration. We believe advocacy is often a critical tool that boardsmust consideras a potential way to most effectively and efficiently advance their organization’s mission. For purposes of subsection , any person with a material financial interest in such a provider-sponsored organization shall be treated as a private shareholder or individual with respect to the hospital. These nonprofits qualify for that status because they’re dedicated to an “exempt purpose,” the IRS says. Exempt purposes can be charitable, religious, educational, scientific, literary or preventing cruelty to children or animals.

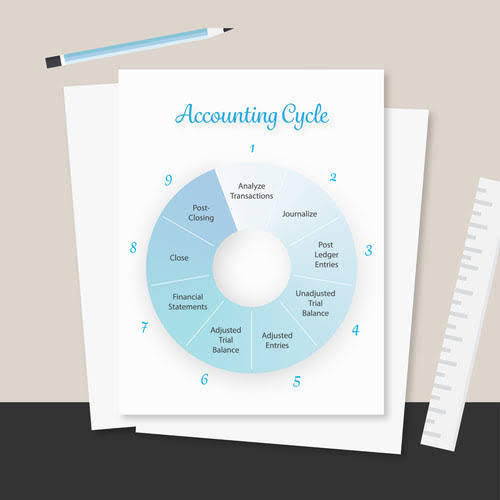

There is a requirement that nonprofits receive at least of third of their income from donations given by the general public. In the world of charitable activities, it’s common to hear people using the terms nonprofit organization and 501 in reference to all charitable organizations. There’s a good deal of truth in that, but it’s not quite that simple. The federal government recognizes different types of charitable organizations, and there are different rules for each of them, depending on the classification. An easy way to think about the difference between public charities and private foundations is to look at the Bill and Melinda Gates Foundation, they provide educational grants that pay for worthy candidates’ undergraduate and graduate degrees. 501 is the internal revenue code section for organizations with tax exempt status.

By contrast, private non-operating foundations are required to pay out 5 percent or more of their assets each year in grants. Many people assume that all nonprofit corporations are the same. In actuality, while there are some similarities between different types of nonprofit companies, there are also some important distinctions depending on their Internal Revenue Code classifications.

If you have not incorporated as a nonprofit corporation yet and this is your first time filing, you need to submit the full Nonprofit Articles of Incorporation along with the State application for incorporation to your State. If you have already incorporated as a domestic nonprofit corporation and didn’t include the legal IRS Required Provisions Language, you need to amend your actual Articles of Incorporation and when you send your Form 1023 package to the IRS, you need to include both files. Tax-exempt organizations report their income from stock investments on Form 990, which is the annual informational return tax-exempt organizations must file. Although 501 organizations don’t pay tax, the IRS requires them to report revenue and expenses just like a company that is subject to tax. Statutory public charities are considered charities as a matter of law and generally perform charitable activities rather than issuing grants. Some examples of statutory public charities are churches, universities, schools, nonprofit hospitals, and medical research institutions.

Can A 501c Corporation Apply For Grant Money?

This is the most common type of organization, and it can be a charitable nonprofit, a public nonprofit, or simply a charity. Joanne Fritz is the expert on nonprofit organizations and philanthropy for The Balance Small Business. Amendment by sections 1010, 1016–, and 1018, , of Pub. 100–647 effective, except as otherwise provided, as if included in the provision of the Tax Reform Act of 1986, Pub.

Before donating to a 501 organization, a donor may wish to consult the searchable online IRS list of charitable organizations to verify that the organization qualifies to receive tax-deductible charitable contributions. An individual may not take a tax deduction on gifts made to a 501 organization that is organized and operated exclusively for the testing for public safety. To remain tax-exempt under Section 501, an organization is also required to remain true to its founding purpose.

A plan shall not be considered discriminatory within the meaning of this clause merely because the benefits received under the plan bear a uniform relationship to the total compensation, or the basic or regular rate of compensation, of the employees covered by the plan. For purposes of subparagraph , the term “controlled group” has the meaning given such term by section 831,1 except that in applying section 8311 for purposes of this subparagraph, subparagraphs and of section 1563 shall be disregarded. Any grant or contribution by any governmental entity the purpose of which is substantially related to providing, constructing, restoring, or relocating electric, communication, broadband, internet, or other utility facilities or services.

What Is A Private Foundation?

The 501 status offers a myriad of benefits to the designated organizations and the people they serve. For example, 501 organizations are exempt from paying federal income and unemployment taxes, and patrons who donate to them are allowed to claim a tax deduction for their contributions. However, not all organizations that qualify for the tax category need to submit Form 1023. For example, public charities that earn less than $5,000 in revenue per year are exempt from filing this form.

Charitable income tax deductions for trusts and estates – The Tax Adviser

Charitable income tax deductions for trusts and estates.

Posted: Mon, 01 Mar 2021 08:00:00 GMT [source]

Section 501 is for nonprofits created for social welfare purposes. This may include local employee groups, homeowners’ associations, civil leagues, and similar organizations that are designed to provide social welfare benefits but don’t meet the requirements of Section 501.

Neither a nonprofit corporation nor an unincorporated nonprofit association is automatically exempt from federal or state taxes. An unincorporated nonprofit association may, but is not required to, file with the secretary of state a statement appointing an agent authorized to receive service of process on behalf of the nonprofit association. The filing of the statement does not represent the creation of the nonprofit association; it simply provides a method for a nonprofit association to receive notice of any lawsuit brought against it. Which is not disqualified for tax exemption under section 501 by reason of attempting to influence legislation, and which does not participate in, or intervene in , any political campaign on behalf of any candidate for public office. 501c3 organizations with more than $1,000 in unrelated business income will also need to file Form 990-T and pay taxes on this income. Moreover, all organizations with paid employees will need to file the appropriate forms to pay their employee taxes.

501c3 rules need to be reviewed and standards established then enforced.

Charitable organizations are to be protected.

Orgs hiding behind the murky definitions of current 501c3 rules to acquire tax free-wealth and engage in political machinations need to be regulated.— ew Funk (@ew_funk) May 13, 2021

Nonprofits aren’t allowed to receive a substantial amount of income from unrelated business operations (UBI-unrelated business income). We’re providing an overview that includes how to define a 501 and what the requirements are, as well as specific restrictions and tax implications boards need to be aware of. A 501 organization is tax exempt so long as it remains true to its stated mission and remains compliant with the IRS.

They especially take advantage of tragedies and disasters. Some charities accept non-cash donations, such as clothing and household items. Nonprofit corporations are those formed in which members may not receive any profits of the corporation. Please support his ongoing work to help more people navigate the bureaucracy of establishing a nonprofit.

- Exemption from taxes imposed by federal, state, and local governments.

- 98–369, set out as an Effective Date note under section 1795k of Title 12, Banks and Banking.

- While foundations are often primarily engaged in grantmaking activities, some may engage in their own direct charitable activities or programs.

- We’re providing an overview that includes how to define a 501 and what the requirements are, as well as specific restrictions and tax implications boards need to be aware of.

- The IRS is a good source of general information on the different types of tax-exempt organizations, all of which are under 501 of the Tax Code.

501 organizations may engage in political campaign intervention activities so long as such activities do not represent their primary activity. Interpreting the limitation with a high risk tolerance, some 501 organizations spend 49% of their resources on electioneering. It’s important to note that a 501 organization is expressly prohibited from engaging in more than an insubstantial amount of activities not in furtherance of its exempt purpose. On the other hand, a 501 organization may engage in more than an insubstantial amount of activities not in furtherance of its exempt purpose so long as it is primarily engaged in activities that further its exempt purpose.

Author: Ken Berry